deposit:

- £1

Trading platform:

- Web platform

- Mobile Apps

- FCA

- FSCS

Charles Stanley Direct Review 2024

deposit:

- £1

Trading platform:

- Web platform

- Mobile Apps

- 1:1

- Only stock trading is available in the mobile application

- margin trading is not available

Summary of Charles Stanley Direct Trading Company

Charles Stanley Direct is a broker with higher-than-average risk and the TU Overall Score of 4.96 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Charles Stanley Direct clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Charles Stanley Direct ranks 56 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Charles Stanley Direct is a broker for UK traders and investors who are prepared to pay high trading commissions in conditions of reliability and top quality service.

Charles Stanley Direct is a well-known British asset management and securities trade execution company established in 1792. The company has been providing online brokerage services to the UK residents since 2002.

Charles Stanley Direct is quoted at the London Stock Exchange and regulated by FCA (124412). The company has extensive experience of working with securities and has received many awards and titles. In 2020, Charles Stanley Direct was named Sustainable Investors by Boring Money and Best SIPP Provider by ADVFN portal.

| 💰 Account currency: | GBP |

|---|---|

| 🚀 Minimum deposit: | GBP 1 |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, Shares, Exchange Traded Funds, Commodities, Investment Trusts, Gilts, Funds |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Charles Stanley Direct:

- Regulation by the Financial Conduct Authority of the UK and membership in the deposit insurance and investor compensation scheme (FSCS).

- No minimum deposit requirements for opening an account.

- Low commissions for investing in funds.

- High level of client service.

- Availability of several types of ready-made portfolios with different levels of risk and predicted levels of profit.

- Easy deposit and withdrawal without additional commissions.

👎 Disadvantages of Charles Stanley Direct:

- Works only with UK residents.

- Charges high trading fees for online stock trading and phone dealing, and also charges a monthly fee for using the platform.

- Does not offer margin trading and does not provide leverage.

Evaluation of the most influential parameters of Charles Stanley Direct

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Charles Stanley Direct News

- Analysis of Charles Stanley Direct

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Charles Stanley Direct

- User Reviews of Charles Stanley Direct

- FAQs

- TU Recommends

Geographic Distribution of Charles Stanley Direct Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Charles Stanley Direct

Charles Stanley Direct (Charles Stanley) is one of the oldest brokers at the London Stock Exchange, and it is regulated by the British FCA, which makes it reliable and respectable among the UK investors. On the other hand, the company does not access residents of other countries: foreign citizens can open an account here only in case they reside in the UK at the time of registration and have a personal account at a local bank.

The benefits of Charles Stanley (Charles Stanley Direct) include low (in some cases zero) commissions for funds, quick and professional customer support, free deposits and withdrawals. Trading web platform is simple and user-friendly, although it has a limited number of research instruments. With the mobile application, you can only trade stocks. The broker does not have a desktop version of the platform.

Analysis of trading conditions of Charles Stanley Direct showed that the broker targets investors, who invest capital in British funds. The commissions on trading stocks are high here and the fees for phone dealing can be considered good only by professional market players, who invest more than one million British pounds.

Dynamics of Charles Stanley Direct’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Charles Stanley Direct clients can trade during the day and also invest in asset portfolios medium and long-term. Investors, who do not know how or simply don’t want to select securities to build a diversified portfolio can work with ready-made portfolios.

Foundation Portfolios are ready-made investment portfolios built by Charles Stanley Direct experts

In order to make the search of promising funds easier and help investors achieve the right balance of risk, profit and growth when investing, Charles Stanley Direct offers diversified asset portfolios. Company’s analysts built three types of Foundation Portfolios:

-

Cautious. These are portfolios aimed at preserving capital, therefore consisting of funds with lower volatility and a possibility to ensure some protection against losses. The majority of assets (up to 24%) are the UK stocks.

-

Balanced. These are diverse portfolios built from assets that can diversify each other in case the value of one of the asset classes drops. They largely consist of stocks (British and international) and bonds.

-

Adventurous. These portfolios aim to maximize the returns by including more volatile, but potentially more lucrative assets. These portfolios include UK, US stocks and different assets in practically equal parts.

The beginners without experience and investors who are not willing to monitor and rebalance their portfolios can work with Multi Asset Funds. This service allows you to transfer your equity into management of professional investors of the company.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Charles Stanley Direct’s affiliate program

-

Refer a Friend Program. Under this program, for each new client, who opened an account using the referral link, a partner is awarded a GBP 50 voucher for shopping on Amazon. The voucher becomes valid if the referral deposits a minimum of GBP 15,000 on his/her account and keeps the account balance at this level for three months.

Unlike other brokers, Charles Stanley Direct does not award a one-time money reward or a percentage from the trading commission of the referrals.

Trading Conditions for Charles Stanley Direct Users

Charles Stanley Direct offers its clients access to trading stocks, ETFs and bonds issued by the British government, but still, the company’s focus is on the investment funds. Permanent and temporary residents of the UK (with a valid visa) can open an account with the broker. In addition to trading securities at the London Stock Exchange, the clients of Charles Stanley Direct can perform transactions with foreign assets, but only by phone via a dealing department of the company. There is no minimum deposit requirement, although in order to start investing a trader needs to deposit GBP 50, 100 or 500 depending on the chosen trading strategy.

£1

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Web platform in the Personal Account, mobile application |

|---|---|

| 📊 Accounts: | Investment Account, Flexible Stocks & Shares ISA, Junior ISA, Self-Invested Personal Pension (SIPP) |

| 💰 Account currency: | GBP |

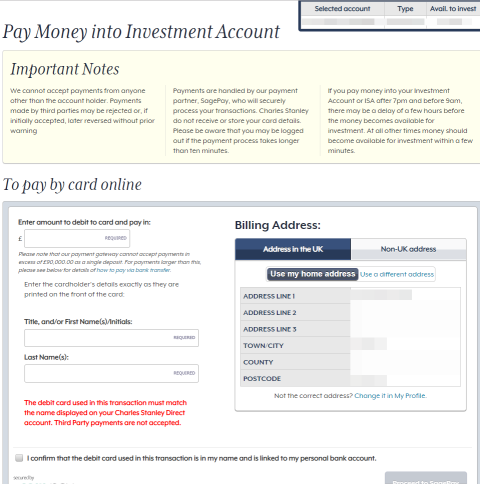

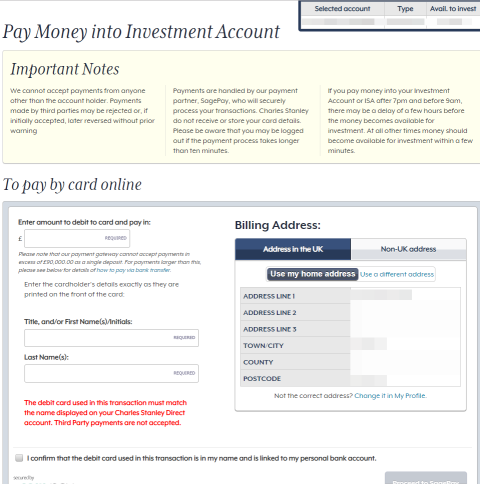

| 💵 Replenishment / Withdrawal: | Wire transfer, debit/credit card (only deposit) |

| 🚀 Minimum deposit: | GBP 1 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, Shares, Exchange Traded Funds, Commodities, Investment Trusts, Gilts, Funds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Thomson Reuters |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Only stock trading is available in the mobile application; margin trading is not available |

| 🎁 Contests and bonuses: | Yes |

Charles Stanley Direct Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Investment Account | From GBP 11.5 | No |

| Flexible Stocks & Shares ISA | From GBP 11.5 | No |

| Stocks & Shares Junior ISA | From GBP 11.5 | No |

| SIPP | From GBP 11.5 | No |

Stamp duty reserve tax of 0.5% is applied on UK share purchases (excl. AIM) and 1% on Irish shares.

We compared the fees of three stockbrokers that they charge on trading stocks, the most popular asset class. In the table below, you will see an average commission per trade without the additional account and trading platform fees.

| Broker | Average commission | Level |

| Charles Stanley Direct | $11.5 | High |

| Charles Schwab | $11 | Medium |

| Ally Bank | $4 | Low |

Detailed Review of Charles Stanley Direct

Charles Stanley Direct offers financial planning and investment management services, including discretion and consultative management. This allows every client of the company to determine how actively he/she wants to be involved in managing their investment, depending on their experience and goals. Traders have access to a wide variety of assets (particularly funds), while the prices, news and basic information are provided by Thomson Reuters.

Interesting figures about Charles Stanley Direct:

-

The earnings in Q2 2021 totaled 171.2 million British pounds.

-

Financial resources of the company increased 6.9% in 2021, up to 100.6 million British pounds.

-

The broker employs 800 people to work in 26 offices.

-

Over 10,000 have downloaded the mobile application.

Charles Stanley Direct is a broker that opens wide investment opportunities and global markets for the UK residents.

Charles Stanley Direct clients can trade not only stocks, funds and bonds in the UK. They also have access to securities quoted at the global exchanges of the US, Europe, Canada and Asia through the telephone dealing service. Charles Stanley Direct provides its clients with newsletters on funds and stocks, screeners for searching promising assets. Chicago Board Options Exchange (CBOE) delivers market data on the index or sector and Thomson Reuters provides selected data.

Maximum investment opportunities open to Charles Stanley Direct clients in the Personal Account, where the trading of all available asset classes takes place. The set of features of the mobile application is somewhat limited. The clients can manage opened accounts there and monitor the effectiveness of built portfolios, but can only trade stocks and shares. The application has Android and iOS versions.

Useful services by Charles Stanley Direct:

-

Foundation Fundlist. This list features a range of Socially Responsible Investments and also passive and actively managed funds, built by the research department based on detailed qualitative and quantitative analysis of the funds.

-

Insights. This is a section of the website with research materials including commentaries of financial experts and fund managers. It also features articles on Socially Responsible Investing, company and market reviews.

-

Market News. This is a newsfeed that covers economic and financial events of the UK.

-

Magnifying glass. This feature allows users to quickly search stocks and funds by the ticker symbol. It supports simple and advanced search.

Advantages:

The broker does not charge an administration fee on investment accounts and ISA.

The company is quoted at a stock exchange and offers a high level of investor protection.

Account opening procedure is fully digitalized and takes no more than 10 minutes, if you have the required documents.

If a client makes at least one trade a month, regardless of whether it’s stocks, ETFs, bonds, commodities or investment trusts, the broker waives the platform charge.

The clients can invest in British and foreign stocks, bonds, ETFs, over 3,000 funds and investment trusts.

Key research instruments, trading ideas, news and market data from reliable suppliers are available.

Investors can use any trading strategy: intraday trading, investment in ready-made portfolios, transfer investment into management or build asset portfolios independently.

How to Start Making Profits — Guide for Traders

Charles Stanley Direct offers four account types. The company’s clients can use only their own equity to trade on all accounts. The broker does not have a minimum deposit as such, but the minimum payment amount on the card is GBP 20.

Account types:

The broker does not offer a demo account. All account types are opened for free and do not require a minimum deposit. However, you can start investing in securities only once you fund your account.

Charles Stanley Direct is a broker for traders and investors living in the UK and investing not only in the local securities, but also in the instruments of the international markets.

Bonuses Paid by the Broker

Loyalty Program

Under the program, the participants are offered additional advantages, such as no platform charge, detailed reports on capital increase for tax declaration, etc.

A GBP 50 voucher for new clients

Traders who registered with the broker using a referral link of the current Charles Stanley Direct client can get an Amazon voucher. The voucher becomes valid once the client funds the account for a minimum amount of GBP 15,000 and maintains the balance for 3 months.

Investment Education Online

All educational information is featured in the New to Investing? tab of Our Services section. Educational materials of Charles Stanley are of good quality, but their quantity and volume are limited.

The footer of the website also features a glossary of all terms mentioned on https://www.charles-stanley-direct.co.uk/.

Security (Protection for Investors)

Charles Stanley Direct is a brand name of Charles Stanley & Co. Limited, a company with reference number 1903304. It is a member of the London Stock Exchange and is regulated by the Financial Conduct Authority (No. 124412).

All investments placed in Charles Stanley Direct participate in the Financial Services Compensation Scheme (FSCS), which protects deposits for an amount of up to GBP 85,000 per client for each bank or credit organization. FSCS is regulated by the FCA and Prudential Regulation Authority and is designed to protect clients in case of bankruptcy of the financial services company. Securities of investors are held at Cofunds, Allfunds Bank, Euroclear and BNY Mellon.

👍 Advantages

- In case the broker files for bankruptcy, every client receives a compensation in the amount of up to GBP 85,000

- FCA makes sure that the broker fulfills the obligations to the clients specified in the agreement

- Assets of the clients and the broker are held separately

👎 Disadvantages

- Account opening is available only to the UK residents

- The funds can be withdrawn only via a wire transfer

- Personal and tax data verification is mandatory

Withdrawal Options and Fees

-

You can only withdraw funds via a wire transfer and only to the account opened in the name of the client.

-

The broker does not charge a withdrawal fee.

-

The money to the bank account is credited within 2 working days after Charles Stanley approves your withdrawal request.

Customer Support Service

Online and phone operators can be reached from 7:30 am until 5:00 pm from Monday till Friday.

👍 Advantages

- Live chat

- Online technical support operators respond within 5 minutes

👎 Disadvantages

- Does not operate 24/7

- Response by email takes up to one day

Here are the ways you can contact customer support:

-

A call on a phone number specified on the website;

-

An email to info@charles-stanley-direct.co.uk;

-

A live chat on the website;

-

A secure message from the control panel;

-

Traditional mail.

The broker also has social media presence: Facebook, Twitter, LinkedIn and Instagram.

Contacts

| Foundation date | 1992 |

| Registration address | Nova House, 3 Ponton Street, Edinburgh EH3 9QQ |

| Regulation |

FCA, FSCS |

| Official site | https://www.charles-stanley-direct.co.uk/ |

| Contacts |

Email:

accounts@charles-stanley-direct.co.uk,

|

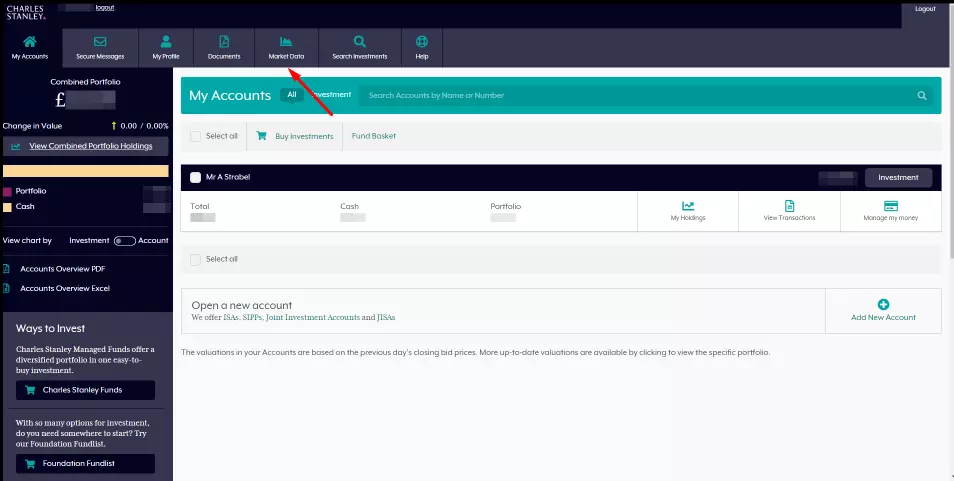

Review of the Personal Cabinet of Charles Stanley Direct

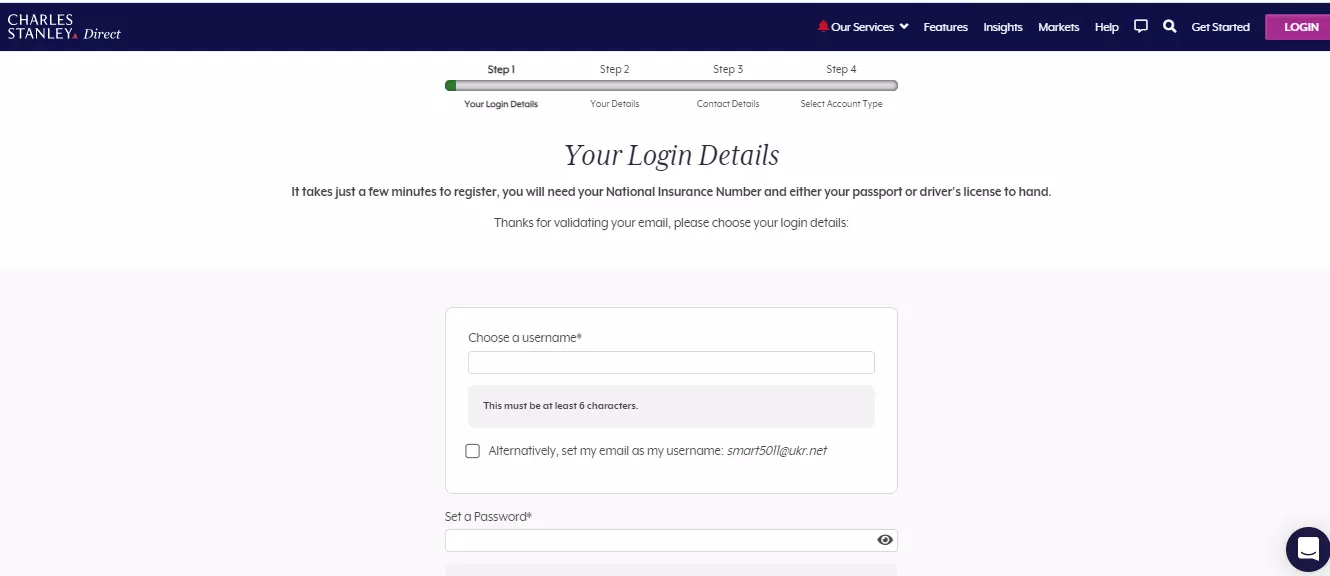

In order to set up a Personal Account on the Charles Stanley Direct website, you need to register and open an account. Only UK residents of full age are eligible for opening an account. Here are the steps:

As soon as you access the broker’s website, click on the Get Started button on the home page.

Next you need to provide your email, come up with a username and password:

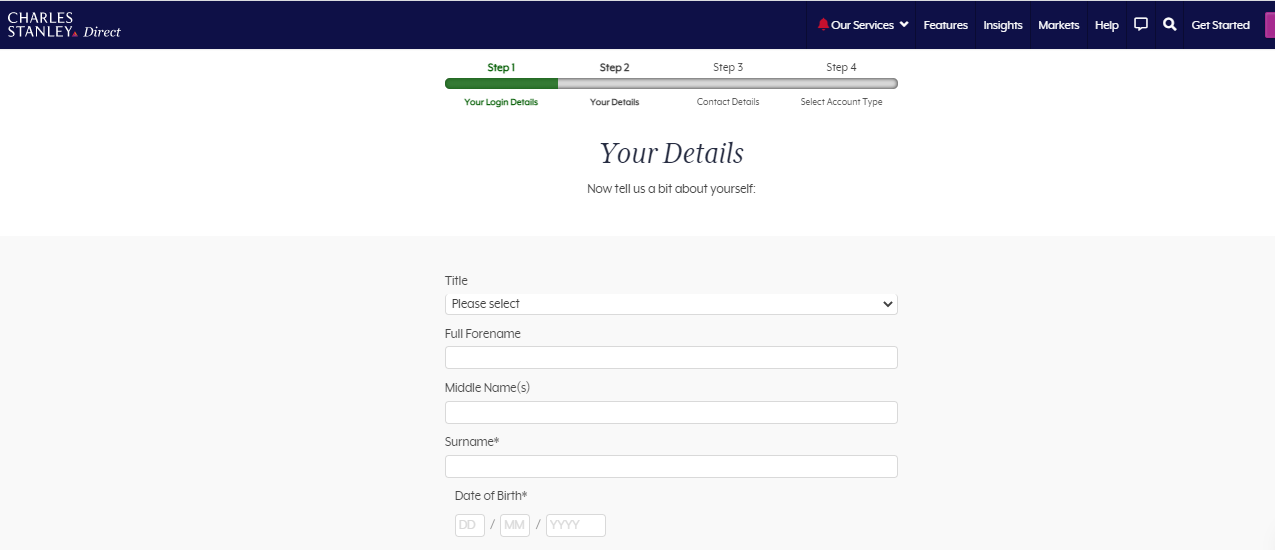

Next, all you have to do is to enter your personal data and financial information:

The company asks you to provide British passport or driver’s license as a proof of identity. However, a potential client, who does not have these documents, can select “I don’t have a British passport or driver’s license” during the registration. In that case, the broker will provide a list of additional documents for continuing the registration procedure.

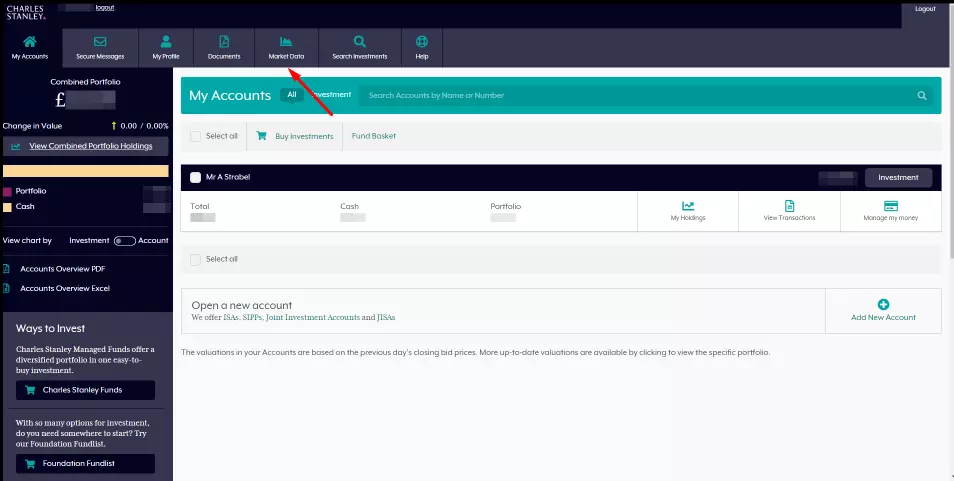

In the Personal Account, a Charles Stanley Direct investor has access to:

1. Market data:

2. Deposit and withdrawal:

1. Market data:

2. Deposit and withdrawal:

In the Personal Account, a trader can:

-

Buy and sell securities through the trading web platform.

-

Search financial instruments for future investment.

-

Set up price alarms and notifications.

-

View portfolio reports – returns and commissions, dates of performed rebalancing.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Charles Stanley Direct rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Charles Stanley Direct you need to go to the broker's profile.

How to leave a review about Charles Stanley Direct on the Traders Union website?

To leave a review about Charles Stanley Direct, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Charles Stanley Direct on a non-Traders Union client?

Anyone can leave feedback about Charles Stanley Direct on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.